If you’ve decided to start your next venture in Australia – great choice! The first step, then, is to look at how to set up your business in Australia.

You can choose from several options for your business or company structure. We go through the most common and advisable options for all businesses, whether you’re a startup, small business / SME, or large enterprise.

When planning out your strategy for Australia, there are a few key factors to consider. You may have already expanded to overseas markets, or be just starting your global growth strategy. Here are some essential considerations to point you in the right direction.

Key Factors To Consider

- I want to remain in Australia for the…

a) short-term

b) long-term

- I want to expand to Australia more for…

a) my presence

b) my operations

- I want to enter the market to…

a) test the waters

b) dive in and start operating

- I want to hire…

a) a representative or small local team

b) more than 20 employees

- I want to set up…

a) as quickly as possible

b) at a slower, more calculated pace

- I want to establish with…

a) a smaller budget

b) more financial liberty

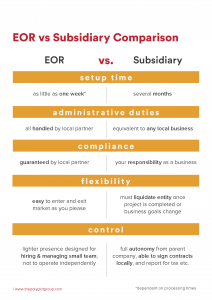

If you answered mostly option a), then the ideal option for you may just be partnering with an Employer of Record (EOR), also known as PEO or Employment Outsourcing.

If you answered mostly option b), then you may be better off establishing your business as a local entity. This could be an Australian branch of your foreign business or a local Australian subsidiary.

Let’s look at option A in more detail.

Using an Employer of Record (EOR)

Using an Employer of Record means simplifying much of the administration and time required to set up a business in Australia.

Your chosen EOR partner takes care of these for you, as they are authorised by the Australian Government to do so. They hold all the necessary licenses, registrations and insurances to employ and process the payroll for your team on your behalf.

Most of all, they are responsible for making sure you remain compliant with all local laws.

As such, you’ll be able to:

- have a light presence in Australia

- hire and sponsor foreign employees locally through a partner

- outsource admin (employment contracts, payroll, tax & withholdings, etc.)

- manage the day-to-day tasks for your staff

- send your own staff to Australia (through an optional, specialised add-on)

- conduct market research

- test the local market

For a short-term project in Australia or if your business is in the earlier stages of its expansion, this is a great way to get started with fewer strings attached. If you at any time wish to end your work in Australia, for example, you will not need to dissolve a whole entity to do so. Rather, you can simply enter and exit the market as you please with the help of your local partner.

Employment Outsourcing is ultimately an all-in-one solution that lets you set up in minimal time, hire, and get a feel for the market.

You won’t need to incorporate your business or register with local authorities, thus saving you substantial time and documentation. Find out more about this option here.

Now for option B…

Opening A Branch

For a more established setup option, you may choose to open an Australian branch of your foreign company. This will enable you to do business locally, operating under your foreign parent company rather than as a separate legal entity (see: subsidiary). This means it does not have limited liability and is not recognised as having a separate legal identity.

By registering your business as a branch, you will need to undergo numerous administrative processes. These can be more time-consuming than other setup options, such as opening a subsidiary. You’ll also need to appoint a local agent (i.e. representative), who is either an Australian resident or Australian company.

(It is important to note that a branch, whilst treated as an extension of your foreign company, must still respect and abide by Australian legislation.)

Establishing A Local Subsidiary

The other option if you wish to incorporate your business is establishing a local Australian subsidiary. A subsidiary essentially operates like any other local Australian business, meaning that you’ll have a strong, established local presence.

For long-term expansion plans, opening a subsidiary is a highly popular option for setup. By definition, a subsidiary is a separate legal entity, meaning limited liability for tax and legal purposes (as it is independent of your parent company).

With a subsidiary, you’ll be able to:

- have a strong presence in Australia

- hire locally and directly

- outsource admin (employment contracts, payroll, tax & withholdings, etc.), if desired

- manage however many staff you want

- sign local contracts

- lease offices and warehouses

- open local bank accounts

- operate as a fully-functional local business

- choose how to structure capital (shares and shareholders)

- claim the Goods & Services Tax (GST)

You’ll need to elect a local director who is an Australian resident. They can either be an employee of your local company or be unrelated to the business.

As it will operate as a local business, your subsidiary will need to register with all necessary authorities including the Australian Taxation Office. You will also need to process your employees’ payroll compliantly, as well as manage their HR as required. To stay on top of local laws, however, you may want to outsource these to an expert.

February 18, 2020

February 18, 2020