Unsettled Employer-Employee Relationship

As we traverse the evolving landscape of employee-employer dynamics, it becomes evident that traditional paradigms are undergoing profound transformations. The contours of the modern workplace are shaped by nuanced expectations and interwoven complexities, demanding a human-centric approach to foster harmonious relationships and sustainable growth. In this article, we will delve into the various facets of… Read more »

8 Things You Should Know About Spain’s Business Culture

Embarking on a professional journey in Spain involves more than just mastering the language and loving the weather and the beautiful beaches; it requires a nuanced understanding of the country’s unique business culture and practices. Spain has become a hub for tech companies and young talent, but it is important to know how business is… Read more »

Unleashing the Power of Digital Change for Your Business

Digital transformation refers to the integration of digital technologies into various aspects of a business, resulting in fundamental changes to how the organisation operates, delivers value to customers, and engages with stakeholders. It involves leveraging digital tools, technologies, and data to enhance business processes, improve efficiency, and create new opportunities for growth and innovation. The… Read more »

Lunar New Year 2024: What to Expect This Chinese New Year

Sunday, 10th February 2024 marks the beginning of the new lunar year. This year will be the Year of the Dragon, the fifth of all zodiac animals. This period stands out for its rarity and significance, emphasising the pursuit of dreams, creativity, and the expansion of horizons. It invites a year of generosity, compassion, and… Read more »

7 Things to Consider When Relocating an Employee to France

France is not only the country of baguette, good cheese, and excellent wine. It is much more complex and offers its challenges when in day-to-day living. Below are some tips to ensure that your employees settle well when relocating to this country: Improve your employee experience. A change in professional life leading to a change… Read more »

Unlocking Success: The Power of Talent Mapping in Competitive Markets

In the dynamic landscape of today’s talent market, staying ahead requires strategic insights and a proactive approach. One invaluable tool that organisations are leveraging to gain a competitive edge is talent benchmarking or market mapping. What is Talent Mapping? Talent benchmarking involves a comprehensive analysis covering salary ranges, benefits, qualifications, experience, and job responsibilities of… Read more »

How to Leverage Your Employer Branding for Talent Acquisition

In today’s competitive job market, it’s not enough to simply offer a competitive salary and benefits package to attract top talent. Companies must also have a strong brand culture that resonates with potential employees. But what exactly is brand culture, and how can you leverage it for talent acquisition? In this article, we’ll explore the… Read more »

Keep up to Date with 2024 Public Holidays in Australia

In Australia, there are 8 national public holidays observed as part of the National Employment Standards (NES) that underpin employment throughout the country. In addition to these key dates, some states and territories also have additional regional public holidays or substitute public holidays. Substitute public holidays mean that if a public holiday falls on… Read more »

Polyglot Bronze Winner in the HRD’s Service Provider Awards for Recruitment Firms

Polyglot, your trusted boutique recruitment consultancy, is thrilled to share the exciting news of securing the bronze medal in the recruitment firms category at the esteemed Human Resources Director’s sixth annual Service Provider Awards. This prestigious accolade is not just a recognition of our commitment to excellence but a celebration of our shared success in… Read more »

Keep up to Date with 2024 Public Holidays in France

France observes and celebrates many holidays throughout the year, whether religious holidays, seasonal holidays, or national holidays relevant to the history of France. Should your foreign business have a presence in France, or you’re interested in learning more about French culture it is important to keep on top of all public holidays from an HR… Read more »

France

An economic force in

the heart of Western Europe

Interested in doing business in France?

Here’s what you need to know about

the business climate, laws and regulations,

culture, and customs in France.

Country Snapshot

Official Language

French

Currency

Euro

Economy

7th in the world

World Zone

Europe

Capital

Paris

-

Key Facts & Figures

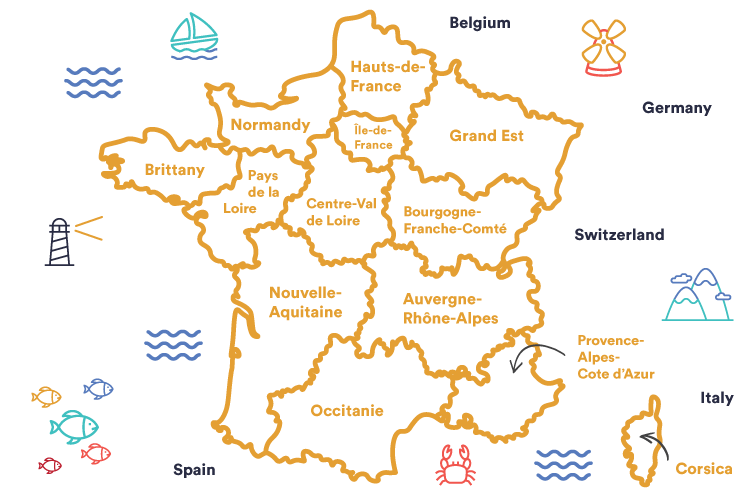

Location

Located in north-western Europe bordering multiple other European countries as well as being the biggest Western European country, France holds an advantageous geographical position. There are 13 regions of metropolitan France, including Corsica and 5 overseas regions.

France includes a number of overseas territories in its sovereignty. These are Guadeloupe, Martinique, Saint-Martin, Saint-Barthélemy, Saint Pierre and Miquelon (Atlantic Ocean); Reunion Island, Mayotte, the French Southern and Antarctic Lands (Indian Ocean); and French Polynesia, New Caledonia, Wallis and Futuna (Pacific Ocean).

Population

France’s population is approximately 68 million, making it the second-most populated country in Europe after Germany. The population continues to increase over the years, though at a slower pace since 2015. This is primarily due to a rise in immigration – France ranks 20th in the world for migrant intake. France also has one of the longest life expectancies, at 82.5 years old (2019).

-

Culture

French business culture is characterised by a strong work-life balance, with regulations ensuring at least 11 consecutive hours away from work for employees. Lunch breaks are considered sacred and typically last between one to one and a half hours. The dress code is generally formal, although ‘Casual Friday’ is gaining popularity in some sectors. Meetings are formal, should be arranged well in advance, and there’s a clear separation between professional and personal life.

Additionally, France is known for its generous public holidays, which contribute to its reputation as an employee’s paradise.

-

Economy

As a highly developed country and one of Europe’s founding members, France has the seventh-largest economy in the world. Its GDP value represents 4.17% of the world economy, with a total GDP of 2.832 trillion USD (2020). The French GPP (gross private product) growth is stable, with an increase of 1.6% in 2018.

Trade

France is the second-largest exporter in Europe after Germany. Exports play a crucial role in maintaining the growth of the French GDP.

French exports and imports are mainly trading within the EU. Indeed, only one-third of all exports is going to economies outside Europe. From these economies, China is the largest expeditor for French import and the United States is the largest destination for French exports.

Top Imports & Exports

More than one-third of both imports and exports are traded with Germany, which represents France’s strongest trading partner (respectively 17% and 19%). In terms of export goods, the country is one of the world’s largest exporters of farming and agricultural products in Europe.

Globally, France is a major exporter of aircraft & spacecraft machinery and ‘delicatessen’ (deli) food products such as wines, spirits and cheeses.

As for services, the largest imports to France are transportation and travel services. France is also the most-visited country worldwide, making tourism a crucial part of the economy.

Free Trade Agreements

As a member of the European Union, France follows the trade policy set for the EU. However, many bilateral and regional trade agreements have also been implemented over the years between the EU and several foreign countries.

-

Legislation

Expanding to France? Here is a breakdown of the key things to keep in mind.

Company Setup

France has a lot to offer in terms of business opportunities. It is actually easier to start a business in France than in most other G20 countries.

There are 2 types of business structures to choose from when creating a business in France: a sole trader and a company. The company includes either a subsidiary, a branch office or a liaison office. The tax regime will depend on your chosen business structure.

After that, the next step is to register your business through the CFE. You will also have to ensure you have the necessary funds to deposit the legal minimum of share capital, according to your business type.

Payroll

France has many regulations that make it one of the world’s most complex and challenging countries for payroll. The payroll regime depends on your chosen business structure.

Considering the regulations imposed on the branch and liaison office, the subsidiary option is the most common and preferable for the long-term.

To comply with the French system, both employers and employees must contribute to France’s mandatory social insurance system. The employer’s contribution generally amounts to approximately 50% of the employee’s salary. The employee’s contribution is 20% of their gross wage, directly deducted by the employer.

In 2017, a new automated process was implemented, known as the Déclaration Sociale Nominative (DSN). This must now be implemented with the payroll system to comply with the social welfare reporting requirements.

Employment

Foreign workers are employed under the same working conditions as locals, although there may be some varying conditions depending on the employee category.

Employment contracts must meet local standards and be drafted in the French language. The minimum for full-time working hours per week is 35 and the maximum is 48.

Immigration

For citizens within the EU/EEA or Switzerland, it is legal to work in France without a work permit. For others, a work permit must be granted prior to any visa or stay document. The procedure must be organised by an employer.

If you plan on staying for fewer than 90 days, a short-stay work visa will suffice. For a longer stay, a long-stay work visa is required. There are different types of visas to work in France and the French law differentiates between a visa and a stay document (known as a ‘carte de sejour’).

The general rule stipulates that a stay document will not be delivered unless first approved by a foreign Consulate.

Tax

As with many European countries, the French tax year follows the calendar year, so from 1 January to 31 December. The standard corporate income tax rate is 33.33%. French corporate tax is payable quarterly on 15 March, 15 June, 15 September, and 15 December.

If you fail to pay on time, late interest may apply. In addition, a 40% penalty can be applied in the case of negligence or 80% for fraud.

Some taxes are deductible for a subsidiary. For a sole trader company, tax is automatically calculated under the personal income tax system or under the rules of the régime micro-entrepris or régime du reel. The national sales tax on goods and services is known as the TVA, which is 20%.