5 Pillars To Meaningful Intercultural Communication

There is an increasing focus in modern business on being global, diverse, and cosmopolitan. But why? Whilst you may think of these as little more than fun buzz words, understanding globality and diversity is crucial in today’s international environment – corporate or otherwise. Because this is the reality and future of the world… Read more »

Future-Proofing Employee-Employer Relationships

As we traverse the evolving landscape of employee-employer dynamics, it becomes evident that traditional paradigms are undergoing profound transformations. The contours of the modern workplace are shaped by nuanced expectations and interwoven complexities, demanding a human-centric approach to foster harmonious relationships and sustainable growth. In this article, we will delve into the various facets of… Read more »

8 Things You Should Know About Spain’s Business Culture

Embarking on a professional journey in Spain involves more than just mastering the language and loving the weather and the beautiful beaches; it requires a nuanced understanding of the country’s unique business culture and practices. Spain has become a hub for tech companies and young talent, but it is important to know how business is… Read more »

Unleashing the Power of Digital Change for Your Business

Digital transformation refers to the integration of digital technologies into various aspects of a business, resulting in fundamental changes to how the organisation operates, delivers value to customers, and engages with stakeholders. It involves leveraging digital tools, technologies, and data to enhance business processes, improve efficiency, and create new opportunities for growth and innovation. The… Read more »

Lunar New Year 2024: What to Expect This Chinese New Year

Sunday, 10th February 2024 marks the beginning of the new lunar year. This year will be the Year of the Dragon, the fifth of all zodiac animals. This period stands out for its rarity and significance, emphasising the pursuit of dreams, creativity, and the expansion of horizons. It invites a year of generosity, compassion, and… Read more »

7 Things to Consider When Relocating an Employee to France

France is not only the country of baguette, good cheese, and excellent wine. It is much more complex and offers its challenges when in day-to-day living. Below are some tips to ensure that your employees settle well when relocating to this country: Improve your employee experience. A change in professional life leading to a change… Read more »

Unlocking Success: The Power of Talent Mapping in Competitive Markets

In the dynamic landscape of today’s talent market, staying ahead requires strategic insights and a proactive approach. One invaluable tool that organisations are leveraging to gain a competitive edge is talent benchmarking or market mapping. What is Talent Mapping? Talent benchmarking involves a comprehensive analysis covering salary ranges, benefits, qualifications, experience, and job responsibilities of… Read more »

How to Leverage Your Employer Branding for Talent Acquisition

In today’s competitive job market, it’s not enough to simply offer a competitive salary and benefits package to attract top talent. Companies must also have a strong brand culture that resonates with potential employees. But what exactly is brand culture, and how can you leverage it for talent acquisition? In this article, we’ll explore the… Read more »

Keep up to Date with 2024 Public Holidays in Australia

In Australia, there are 8 national public holidays observed as part of the National Employment Standards (NES) that underpin employment throughout the country. In addition to these key dates, some states and territories also have additional regional public holidays or substitute public holidays. Substitute public holidays mean that if a public holiday falls on… Read more »

Polyglot Bronze Winner in the HRD’s Service Provider Awards for Recruitment Firms

Polyglot, your trusted boutique recruitment consultancy, is thrilled to share the exciting news of securing the bronze medal in the recruitment firms category at the esteemed Human Resources Director’s sixth annual Service Provider Awards. This prestigious accolade is not just a recognition of our commitment to excellence but a celebration of our shared success in… Read more »

New Zealand

The forward-thinking

island nation

Interested in doing business in New Zealand? Here’s what you need to know about the

business climate, laws and regulations,

culture, and customs in New Zealand.

Country Snapshot

Official Language

English, Maori

Currency

New Zealand Dollar (NZD)

Economy

50th in the world

World Zone

Asia Pacific / Oceania

Capital

Wellington

-

Key Facts & Figures

Location

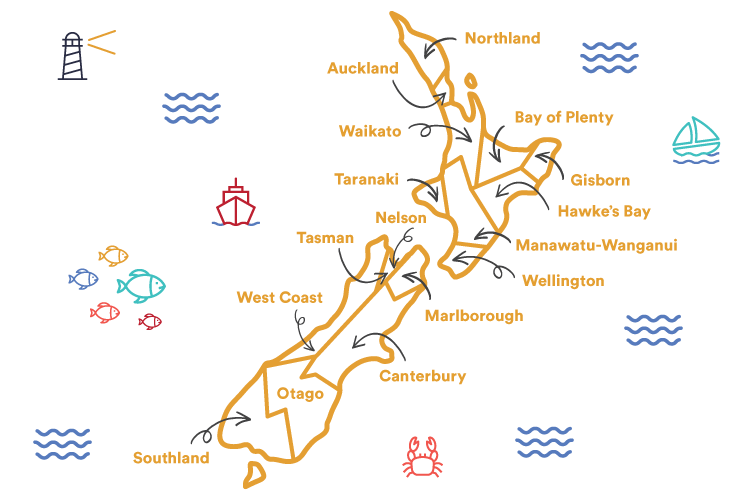

Due to its rather isolated location, New Zealand is a fairly young country, comprised of 2 main islands: the North Island and South Island. Beyond these more populated regions, New Zealand consists of nearly 600 smaller islands.

There are sixteen regions in New Zealand: eleven are governed by regional councils and five by unitary authorities.

Population

New Zealand’s population is approximately 5 million. This continues to increase, with a growth rate of roughly 2% and an estimated population of 5 million by 2025.

New Zealand’s population is largely focused in urban areas (nearly 87% of the population). The median age is 37.4 years.

-

Economy

New Zealand is a developed economy that continues to grow and look for areas of diversification by finding new markets and products and supporting free trade agreements.

The country is closely linked with its neighbour, Australia, which represents its biggest importer, supplier and investor of goods and services. Tourism and the exportation of agricultural products currently fuel economic growth. Services are the largest sector of the economy, accounting for nearly 72.8 percent of the GDP. Overall, GDP growth remains at an annual average of 3%.

Trade

New Zealand’s trade is largely focused around agriculture as the world’s 12th largest agricultural exporter by value and the second-largest dairy exporter.

With a strong financial system and low unemployment rate, the New Zealand economy is centred around trade. The country has strong trade agreements with Australia and Asia, having established a free-trade agreement with China and becoming associated with the Association of Southeast Asian Nations (ASEAN). Similarly to Australia, New Zealand is considered a gateway for American, European & Asian companies looking to explore trade in the Asia Pacific region.

Top Imports & Exports

With strong trade ties to Australia, Asia, and the US, New Zealand enjoys a wide variety of export markets. The export value in 2017 was $37.3 billion, while imports came in at $36.3 billion, creating a positive trade balance.

The country holds an abundance of natural resources, agricultural and food products (especially milk, meat, and wood), and machinery equipment – all of which make up its primary exports.

China represents New Zealand’s biggest market for exports, totalling $8.79 billion, with a large portion coming from concentrated milk and rough wood products.

Australia and the United States follow China as New Zealand’s 2nd and 3rd largest export destinations, accounting for $5.61 billion and $3.61 billion

Top imports into New Zealand include cars, crude petroleum, refined petroleum, delivery trucks, and broadcasting equipment. Top import origins are China, Australia, the US, Japan and Germany.

Free Trade Agreements

New Zealand has FTAs with Australia, Hong Kong, China, Malaysia, Thailand, Korea and Singapore. It is also a part of ASEAN, a free trade agreement that spans across the Asia Pacific, P4, the Trans-Pacific Strategic Economic Partnership linking Asia, the Pacific and the Americas and CPTPP, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, which includes 11 countries in the Pacific region.

-

Legislation

Expanding to New Zealand? Here is a breakdown of the key things to keep in mind.

Company Setup

Setting up your business in New Zealand can be done in as little as three days through various methods, such as partnering with an Employer of Record, registering as a foreign entity, transferring your company to New Zealand, or opening a local subsidiary or branch. New Zealand is ranked 3rd in the OECD for cross-border transactions with foreign partners.

Registering your business is quite simple. Once you have reserved your business name and provided the required information, your application can be submitted for processing.

New Zealand has made it especially easy for businesses already incorporated in Australia. Much of the required information, such as your certificate of incorporation, director’s details and company constitution are directly supplied by ASIC. Additionally, you can enter your Australian Company Number (ACN) to ensure that the company name remains the same when registering in New Zealand.

Employment

The workforce in New Zealand continues to grow annually at a rate of 1.8%, meaning an additional 47,000 workers per year. New Zealand uses a standard employment contract template with a few modifications pertaining to probationary periods, employee benefits and PTO. There are no official working hour rules, but business hours in New Zealand tend to be from 8:30 am to 5 pm.

Every employee in New Zealand must have a written employment agreement, listing the terms and conditions of employment. For all employees aged 16 and over, the minimum wage is enforced for all hours worked and there is no minimum hour requirement. Employees can take parental leave if they meet the six- or twelve-month criteria, depending on the length of employment prior to the due date of the baby.

All full-time employees have a minimum of four weeks’ annual leave and there are 11 public holidays throughout the year.

Immigration

The skilled migrant category resident visa is the most commonly used to employed skilled foreign workers in New Zealand. The visa can be sponsored by an organisation registered in New Zealand as a company. To be accepted for this visa, applicants will need 160 points, based on the points guide.

Payroll

If your company needs to pay employees in New Zealand, you will need to complete the IR334 form via the IRD (the national tax authority). Employers in New Zealand have certain statutory obligations involving withholding tax and specific social security contributions from each pay-cycle.

It is not mandatory in New Zealand for companies to issue payslips, but it is still common and is an employee’s right to have access to information about the way that their wages are calculated. Foreign companies may choose to outsource their payroll to ensure compliance.

Tax

In New Zealand, the Financial Year for companies ends on 31 March. Corporate tax returns, not linked to an agent, must be filed by 7 July for balance dates between 1 October and 31 March, or by the seventh day of the fourth month following a balance date between 1 April and 30 September. Otherwise, if linked to a tax agent, the filing date can be extended to 31 March of the following year.

The national sales tax is known as the Goods and Services Tax (GST) – the equivalent of the VAT in Europe or Sales Tax in the US. GST is a broad-based tax of 15% that applies to most goods, services, and other items sold or consumed within New Zealand. It is chargeable on any business connected to New Zealand, and the returns must be filed at the end of every taxable period.