Unsettled Employer-Employee Relationship

As we traverse the evolving landscape of employee-employer dynamics, it becomes evident that traditional paradigms are undergoing profound transformations. The contours of the modern workplace are shaped by nuanced expectations and interwoven complexities, demanding a human-centric approach to foster harmonious relationships and sustainable growth. In this article, we will delve into the various facets of… Read more »

8 Things You Should Know About Spain’s Business Culture

Embarking on a professional journey in Spain involves more than just mastering the language and loving the weather and the beautiful beaches; it requires a nuanced understanding of the country’s unique business culture and practices. Spain has become a hub for tech companies and young talent, but it is important to know how business is… Read more »

Unleashing the Power of Digital Change for Your Business

Digital transformation refers to the integration of digital technologies into various aspects of a business, resulting in fundamental changes to how the organisation operates, delivers value to customers, and engages with stakeholders. It involves leveraging digital tools, technologies, and data to enhance business processes, improve efficiency, and create new opportunities for growth and innovation. The… Read more »

Lunar New Year 2024: What to Expect This Chinese New Year

Sunday, 10th February 2024 marks the beginning of the new lunar year. This year will be the Year of the Dragon, the fifth of all zodiac animals. This period stands out for its rarity and significance, emphasising the pursuit of dreams, creativity, and the expansion of horizons. It invites a year of generosity, compassion, and… Read more »

7 Things to Consider When Relocating an Employee to France

France is not only the country of baguette, good cheese, and excellent wine. It is much more complex and offers its challenges when in day-to-day living. Below are some tips to ensure that your employees settle well when relocating to this country: Improve your employee experience. A change in professional life leading to a change… Read more »

Unlocking Success: The Power of Talent Mapping in Competitive Markets

In the dynamic landscape of today’s talent market, staying ahead requires strategic insights and a proactive approach. One invaluable tool that organisations are leveraging to gain a competitive edge is talent benchmarking or market mapping. What is Talent Mapping? Talent benchmarking involves a comprehensive analysis covering salary ranges, benefits, qualifications, experience, and job responsibilities of… Read more »

How to Leverage Your Employer Branding for Talent Acquisition

In today’s competitive job market, it’s not enough to simply offer a competitive salary and benefits package to attract top talent. Companies must also have a strong brand culture that resonates with potential employees. But what exactly is brand culture, and how can you leverage it for talent acquisition? In this article, we’ll explore the… Read more »

Keep up to Date with 2024 Public Holidays in Australia

In Australia, there are 8 national public holidays observed as part of the National Employment Standards (NES) that underpin employment throughout the country. In addition to these key dates, some states and territories also have additional regional public holidays or substitute public holidays. Substitute public holidays mean that if a public holiday falls on… Read more »

Polyglot Bronze Winner in the HRD’s Service Provider Awards for Recruitment Firms

Polyglot, your trusted boutique recruitment consultancy, is thrilled to share the exciting news of securing the bronze medal in the recruitment firms category at the esteemed Human Resources Director’s sixth annual Service Provider Awards. This prestigious accolade is not just a recognition of our commitment to excellence but a celebration of our shared success in… Read more »

Keep up to Date with 2024 Public Holidays in France

France observes and celebrates many holidays throughout the year, whether religious holidays, seasonal holidays, or national holidays relevant to the history of France. Should your foreign business have a presence in France, or you’re interested in learning more about French culture it is important to keep on top of all public holidays from an HR… Read more »

South Africa

The powerhouse of the sub-Saharan African continent

Interested in doing business in South Africa?

Here’s what you need to know about the

business climate, laws and regulations, and

more in the Republic of South Africa.

Country Snapshot

Official Languages

Afrikaans, English, Ndebele +8 more

Currency

South African Rand

(ZAR)

Economy

33rd in the world

World Zone

Africa

Capitals

Pretoria, Cape Town, Bloemfontein

-

Key Facts & Figures

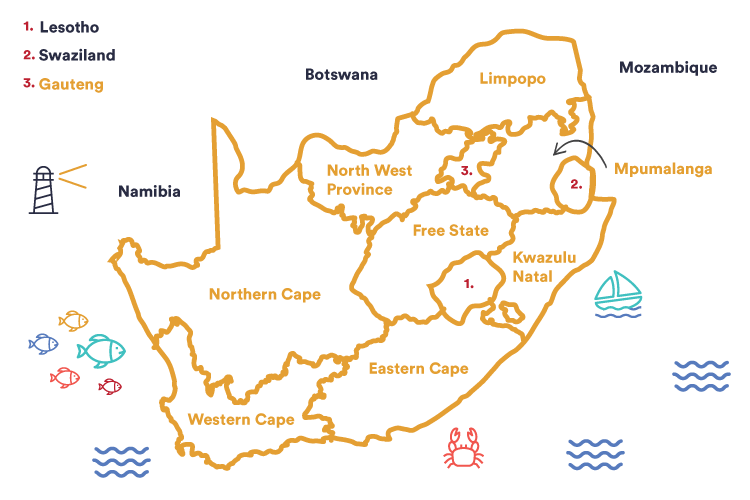

Location

Located at the southernmost tip of Africa, South Africa is the 25th largest nation in the world by total area and is wedged where the Atlantic Ocean meets the Indian Ocean.

South Africa has 3 capital cities: Pretoria/Tshwane (administrative), Cape Town (legislative) and Bloemfontein (judicial).

The country has 9 provinces: Eastern Cape, the Free State, Gauteng, KwaZulu-Natal, Limpopo, Mpumalanga, the Northern Cape, North West and the Western Cape.

Population

The population is around 59 million. The country is ranked 24th in the world by population size. South Africa has a very young population, with a median age of 27 years old. The country has 11 0fficial languages: Afrikaans, English, Ndebele, Pedi, Sotho, Swati, Tsonga, Tswana, Venda, Xhosa, and Zulu.

-

Economy

South Africa’s economy grew by 0.8% in 2018 and should continue to grow at a higher rate in the coming years. It is ranked 33rd worldwide with a total GDP of $680.04 billion (2020).

Services and industry are the biggest contributors, responsible for 67.5% and 29.7%, respectively, of the national GDP.

Trade

Mineral resources are a major export asset to South Africa. The country has the world’s 36th largest export economy.

Its main international trade partners are Europe (namely Germany, Spain and the UK), the United States, China & Japan. South Africa has an ongoing trade connection with China. China represents its top export destination, and South Africa enjoys a high volume of Chinese imports.

The country also has a strong relationship with Australia; both members of the Commonwealth. South Africa is also Australia’s largest export market and its most significant investment partner in Africa.

Top Imports & Exports

The country is the world’s largest producer and exporter of gold, platinum, chrome and manganese and the fourth-largest producer of diamonds. Gold represents 15.6% of total exports. Its top imports are crude petroleum, refined petroleum, cars, gold and broadcasting equipment.

Free Trade Agreements

South Africa has a Customs Union Agreement, as well as Free Trade Agreements with several countries. The Southern African Customers Union exists between South Africa, Botswana, Lesotho, Namibia and Swaziland.

Within Africa, South Africa is part of the Southern African Development Community (SADC) FTA, together with 15 other member states. With Europe, South Africa is part of the Trade, Development and Cooperation Agreement (TDCA).

South Africa is also part of the EFTA (Iceland, Liechtenstein, Norway and Switzerland) to reduce tariffs on selected goods.

Since 1 January 2021, South Africa has been part of The African Continental Free Trade Agreement, along with 54 nations of Africa. This has created the world’s largest free-trade area, making it easier to do business across Africa.

-

Legislation

Expanding to South Africa? Here is a breakdown of the key things to keep in mind.

Company Setup

There are two types of business setup in South Africa: a South African subsidiary and “external company”. However, to be registered as a South African subsidiary, at least one of the incorporators must hold a South African visa.

External companies wishing to expand to South Africa do not need a South African visa. However, they must inform the Companies and Intellectual Property Commission (CIPC) with the different required documents within 20 business days of starting to ‘conduct business’ locally.

Setting up a company in South Africa requires a minimum paid-up share capital of 1 USD. A South African LLC can be 100% foreign-owned as only one director and one shareholder must be appointed.

Payroll

All South African companies must comply with annual, bi-annual and monthly PAYE (Pay As You Earn tax), UIF (Unemployment Insurance Fund) and SDL (Skills Development Levy) requirements.

The law demands that if you employ one or more staff members who earn over R40,000 per year, you have to register your company for PAYE.

There are two monthly deadlines in terms of PAYE. First, you need to submit your Monthly Employer Declaration (the EMP201 form). Then, you need to pay your PAYE before the 7th of the following month.

The UIF contribution amounts to 2% in total and there is a cap of R148.72.

If your payroll is more than R500,000 a month, you must register for the skills development levy (SDL). These funds go towards developing and improving the skills of employees.

Foreign nationals are advised to seek professional advice when considering external companies, as South Africa does not have dual taxation treaties with all countries.

Employment

The unemployment rate is quite high in South Africa, at 27.1% (2018).

South African law distinguishes between employees and independent contractors.

From 1 January 2019, no worker must be paid below the national minimum wage, which is currently set at R20 per hour.

Around 7% of the population holds a university degree. This may affect businesses looking to hire from the local workforce. The workforce is multilingual, however, as South Africa has 11 official languages and numerous indigenous languages.

Immigration

To work in South Africa, you will need to apply for a work visa before arriving. You can apply at the South African embassy or consulate in your home country. Apply at least six weeks before you leave your own country to come to South Africa.

There are different types of work visas; however, all work visas require that the holder have a sponsoring employer in South Africa.

Your South African work visa acts as your temporary residence visa.

Corporate worker certificates are applicable in cases where an employer wishes to employ many foreign workers for a limited time period. These are now issued for a maximum period of three years, and the worker’s spouse and children do not qualify for visas by extension. For workers’ families to accompany them to South Africa, the dependents must qualify independently for their own visas.

Tax

South Africa is a high tax country; government revenue comes primarily from income tax, value-added tax (VAT) and corporation tax.

For companies, the tax year is the same as the accounting year. For individuals, the tax year begins on 1 March and ends on the last day of February of the following year (i.e. 28th or 29th).

The corporate tax is 28%. The VAT is 15% (since 1 April 2018).

Individual income tax rates in South Africa range from 18% to 45%, with a tax-free threshold of R78,150 (for persons under 65).