5 Pillars To Meaningful Intercultural Communication

There is an increasing focus in modern business on being global, diverse, and cosmopolitan. But why? Whilst you may think of these as little more than fun buzz words, understanding globality and diversity is crucial in today’s international environment – corporate or otherwise. Because this is the reality and future of the world… Read more »

Future-Proofing Employee-Employer Relationships

As we traverse the evolving landscape of employee-employer dynamics, it becomes evident that traditional paradigms are undergoing profound transformations. The contours of the modern workplace are shaped by nuanced expectations and interwoven complexities, demanding a human-centric approach to foster harmonious relationships and sustainable growth. In this article, we will delve into the various facets of… Read more »

8 Things You Should Know About Spain’s Business Culture

Embarking on a professional journey in Spain involves more than just mastering the language and loving the weather and the beautiful beaches; it requires a nuanced understanding of the country’s unique business culture and practices. Spain has become a hub for tech companies and young talent, but it is important to know how business is… Read more »

Unleashing the Power of Digital Change for Your Business

Digital transformation refers to the integration of digital technologies into various aspects of a business, resulting in fundamental changes to how the organisation operates, delivers value to customers, and engages with stakeholders. It involves leveraging digital tools, technologies, and data to enhance business processes, improve efficiency, and create new opportunities for growth and innovation. The… Read more »

Lunar New Year 2024: What to Expect This Chinese New Year

Sunday, 10th February 2024 marks the beginning of the new lunar year. This year will be the Year of the Dragon, the fifth of all zodiac animals. This period stands out for its rarity and significance, emphasising the pursuit of dreams, creativity, and the expansion of horizons. It invites a year of generosity, compassion, and… Read more »

7 Things to Consider When Relocating an Employee to France

France is not only the country of baguette, good cheese, and excellent wine. It is much more complex and offers its challenges when in day-to-day living. Below are some tips to ensure that your employees settle well when relocating to this country: Improve your employee experience. A change in professional life leading to a change… Read more »

Unlocking Success: The Power of Talent Mapping in Competitive Markets

In the dynamic landscape of today’s talent market, staying ahead requires strategic insights and a proactive approach. One invaluable tool that organisations are leveraging to gain a competitive edge is talent benchmarking or market mapping. What is Talent Mapping? Talent benchmarking involves a comprehensive analysis covering salary ranges, benefits, qualifications, experience, and job responsibilities of… Read more »

How to Leverage Your Employer Branding for Talent Acquisition

In today’s competitive job market, it’s not enough to simply offer a competitive salary and benefits package to attract top talent. Companies must also have a strong brand culture that resonates with potential employees. But what exactly is brand culture, and how can you leverage it for talent acquisition? In this article, we’ll explore the… Read more »

Keep up to Date with 2024 Public Holidays in Australia

In Australia, there are 8 national public holidays observed as part of the National Employment Standards (NES) that underpin employment throughout the country. In addition to these key dates, some states and territories also have additional regional public holidays or substitute public holidays. Substitute public holidays mean that if a public holiday falls on… Read more »

Polyglot Bronze Winner in the HRD’s Service Provider Awards for Recruitment Firms

Polyglot, your trusted boutique recruitment consultancy, is thrilled to share the exciting news of securing the bronze medal in the recruitment firms category at the esteemed Human Resources Director’s sixth annual Service Provider Awards. This prestigious accolade is not just a recognition of our commitment to excellence but a celebration of our shared success in… Read more »

United States

The world’s largest

economy & trading force

Interested in doing business in the United States

of America? Here’s what you need to know about

the business climate, laws and regulations,

culture, and customs in the United States.

Country Snapshot

Official Language

American English

Currency

US Dollar (USD)

Economy

1st in the world

World Zone

North America

Capital

Washington DC

-

Key Facts & Figures

Location

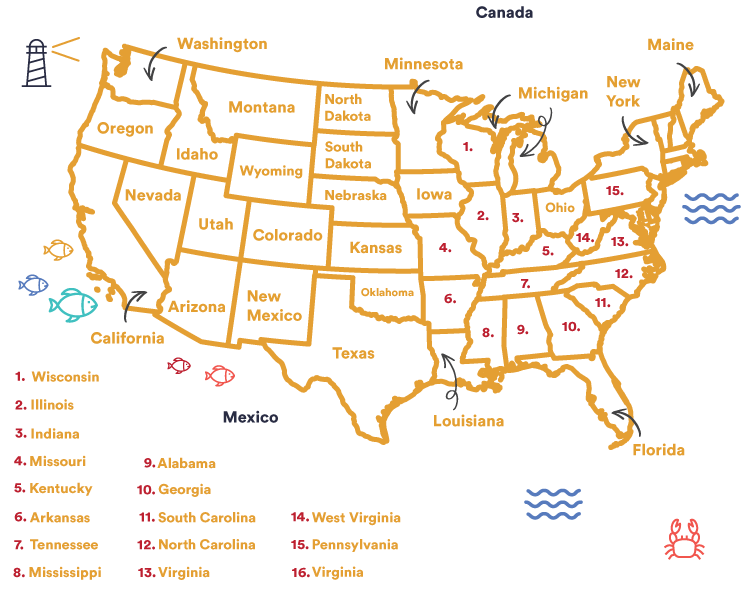

Located in North America, the United States is the 3rd largest nation in the world.

The United States (US) comprise 50 states and 1 federal district. This includes Hawaii and Alaska, although they do not share geographical borders with the country.

The US does border separate nations Cuba, Canada and Mexico.

Population

The US population is approximately 335 million (2020), which makes up just under 5% of the global population. High levels of immigration mean that it continues to grow, with a projected 417 million by 2060.

The nation has a density of 34 people per square kilometre and the most populated states are California, Texas and New York City.

Due to its history, the US has a very diverse and multicultural population.

-

Economy

The US has the world’s largest economy.

It represents about 20% of total global output. It is the world’s largest economy by nominal GDP and the second-largest by purchasing power parity (PPP).

The US is forecasted to remain at the top of the global economy and one of the world’s most powerful countries.

However, its main rival, China, is expected to surpass the US to become the world’s largest economy by 2032.

Trade

The US benefits from its trade relationships with many countries. Its main ties remain with Europe and Asia.

The United States is the world’s second-largest trading nation and is among the top three global importers and exporters.

In 2020, America’s import value is at 2.809 trillion and export value at 2.127 trillion.

Note that the recent US-China trade war continues to impact national and global trade relations.

Top Imports & Exports

US top imports are machinery (including computers), electrical machinery, vehicles, mineral fuels (including oil) and pharmaceuticals.

Pharmaceuticals had the fastest-growing increase in value among the top 10 import categories.

Six of the top 10 US imports also represent its top exports.

Top exports include machinery (including computers), mineral fuels including oil, electrical equipment, aircraft and spacecraft, and automotive vehicles.

Free Trade Agreements

As a key player in the international trade landscape, the US has free trade agreements with 20 countries

One of them is the NAFTA, The North American Free Trade Agreement. It was created in 1994 and is one of the largest trade blocs in the world.

Another agreement exists between Australia and America, by which US companies with Australian subsidiaries can trade with these countries with reduced or no tariffs (in specified industries).

-

Legislation

Expanding to the US? Here is a breakdown of the key things to keep in mind.

Company Setup

Boasting the largest economy in the world, the US provides a very strategic and opportune environment to set up your business.

You don’t have to be a US citizen or to be a US resident or to have a green card to start an LLC or a corporation in America.

The first thing, as for every country, is to choose the right business setup for you. Then, you need to choose a state to register your company. Depending on your needs, some states might be more appropriate or convenient.

You must then complete the certificate of incorporation and get your Employer Identification Number. This number is necessary not just to hire workers, but to open a bank account, pay taxes, or often to get a business licence. It is free and you can apply directly with the IRS.

To simplify setup and ensure you are getting the right solutions for your business, consulting a local partner is very beneficial.

Payroll

In the US, payroll tax is state-based. Every company must register for payroll tax in its state of formation.

There is no federal government standard regarding how frequently employees should get paid. Each state can implement its own law.

However, payroll regulations in the US do apply at both the state and federal level requiring employers to withhold income tax from wages.

Some of the taxes under payroll come under FICA taxes (Federal Insurance Contributions Act). These are taxes levied on both employers and employees and include Social Security and healthcare contributions.

Employment

The Fair Labor Standards Act (FLSA) provides guidelines to employers about employment and compensation. From one state to another, laws may vary.

The unemployment rate is at roughly 3.6% in 2019, forecasted to reach 3.8% by 2021.

Many employees work part-time and job opportunities have increased only in lower-paying retail and food service industries. The minimum wage is US$7.25 (2019).

Immigration

Historically, the American population and society has always been shaped by immigration.

US work visas are broken into two main categories:

- Temporary non-immigrant work visas

- Employment-based immigrant visas (also known as Green Cards), which grant the holder lawful permanent residence.

Popular work-related visa options include the E2, E1, L1, and H1B. For businesses wishing to set up in the US, this can be done at a low cost under the L1 intracompany transfer visa or E2 Treaty Investor Visa or E1 Treaty Trader visa scheme. Permanent residency comes at a higher cost.

Tax

Income tax is charged at both federal and state levels. At the federal level, rates range from 10% to 37% depending on earnings. At the state level, income tax is charged on employee earnings at rates set by individual state legislatures.