The new financial year is here, bringing new and significant changes to New Zealand’s taxation & payroll.

As a business, it is essential to remain up to date on new emerging payroll trends. 2022 comes with a new suite of major changes in employment legislation, and we are here to uncover all the latest changes to help you stay on top of it.

Uncover your 2022 – 2023 guide to the latest payroll trends in New Zealand to help you lookout for this financial year. Please note, changes will be shared in reverse chronological order, so you’ll always find latest news at the top.

April 2022

Upcoming Rate Change

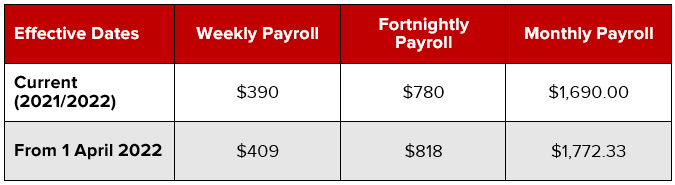

Minimum Wage

The following changes to the minimum wage have been announced. The starting out and training minimum wage remain at 80% of the adult minimum wage.

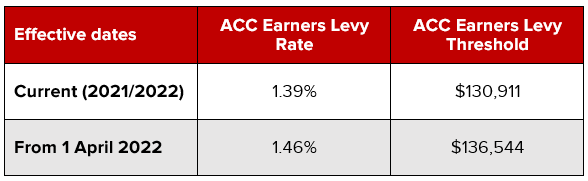

ACC Earners Levy and Threshold – highlighted new changes

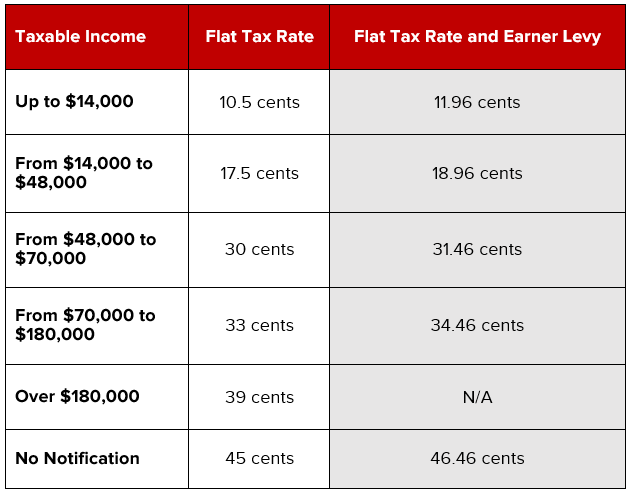

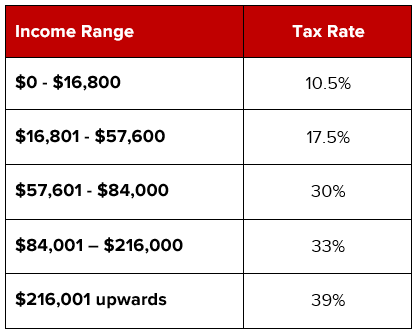

Current Tax Rates for tax year 2022-2023 – No change to tax rates & thresholds

Student Loan Deduction

The student loan percentage will remain the same for the 2022/2023 tax year (12%). However, the annual repayment threshold will increase from $20,280 to $21,268.

New ESCT Rate – No change to ESCT rates

COVID-19 Support for employer to pay their employees

Short-term absence payment – for employees waiting for Covid-19 test results

A One-off payment of $359 applies to employees who:

– Stay home and look after a dependent child who has been asked to get a COVID-19 test

– Live with someone who needs to wait and get a negative test result

This payment can only be applied once for each eligible employee in any 30-day period

https://www.workandincome.govt.nz/covid-19/leave-support-scheme/index.html

Leave support scheme payment

Will be paid at a flat rate of:

– $600 for people who were working 20 hours or more per week (full-time rate)

– $359 for people who were working less than 20 hours per week (part-time rate)

To be eligible for a one-week payment, the employee needs to be self-isolating for at least four consecutive calendar days.

Business’ need to meet certain criteria to be eligible to apply above government support payments, please refer to links above for more information.

Payroll processes are complex and ever-changing. Especially since the pandemic, businesses have been faced with many unexpected changes, leaving a huge impact on their payroll processes. It is crucial to understand your payroll obligations to remain compliant and efficient to avoid any pitfalls.

Our experts simplify payroll and always stay on top of the latest trends. We not only manage payroll in New Zealand but also in Australia and the Pacific territories to ensure you remain compliant. If still unsure of the benefits of outsourcing your payroll, check out our FAQs on why you should, or email our Chief Client Office, Gerald.

April 14, 2022

April 14, 2022