Workers compensation insurance (also known as “work cover”) provides support for workers with a work-related injury.

Most employers in Australia are legally required to have a workers compensation policy to protect them from the costs of workers compensation claims (unless they are exempt).

Workers compensation assists with the costs of weekly benefits, medical and hospital expenses and a range of other benefits to help the worker recover and return to work.

Understanding the nuances of workers compensation is crucial because, while this insurance provides vital support for workers with work-related injuries and is a legal requirement for most employers to protect against claims costs, employers may inadvertently overpay their workers compensation premiums due to variations in the interpretation of “remuneration”; in different states and insurance policies, it can potentially include unnecessary wages resulting in overpay.

Overpaying Your Workers Compensation Premium

Workers compensation premium is calculated on remuneration paid to employees. However, employers might not be aware of the definition of “remuneration”. Different states, or different insurance have different interpretations of which wages are included in remuneration, while some might be exempt from wages.

You might notice some similarities between wages subject to payroll tax and actual wages for workers compensation. However, there are differences between the two. For employers who might just put the total of all pay elements on the actual wages’ declaration, this could lead to premium’s overpayment. Or if employers are referring to wages from payroll tax, they can still get this wrong.

Differences Among States

Some states have state regulatory managing the workers compensation, such as NSW (iCare) and VIC (WorkSafe). The rest might be handled by selected insurance companies, such as NT. Employers will have to refer to each state they are declaring to consider the “wages”. For state regulatory, it will have a consolidated list of wage definitions which rules all insurances in the state. However, for states that allow it, it will be up to the insurance company to decide which wages are included for the premium.

Let’s look at examples. For NSW, termination payments are exempt from wages. This refers to payments such as in lieu of notice and severance. Unused leave payment will be included. For VIC, all termination payments will be exempt, including unused leave.

For WA, WorkCover WA displays a list of wages on their website. However, it is advised that the list is a general guidance only. Employers are expected to follow their insurance policy. In the meantime, the major difference of actual wages declaration among WA and other states is that superannuation contributions made as part of the superannuation guarantees are not included in wages for WA.

Something unique about VIC is that it splits physical work locations. The wages need to be split and reported under each location if there are multiple workplaces. Employers will need to be mindful when submitting the estimated wages in VIC: if at the end of the year, the actual wages are more than 20% above the estimated wages, the employer will get an under-estimation penalty. Therefore, it is suggested to monitor wages paid during the year and update within a month once a rapid increase is noticed.

Group employers shall also register as a group for workers compensation purposes. Be aware that if one employer does not submit the actual wages declaration, it will affect or delay the premium calculation for all other members of the group.

Most insurance offers a discount around 3-5% if the employer pays the full premium by an earlier due date. Sometimes accounts payable might miss it unintentionally, however, there is still an opportunity to negotiate with the insurance company for a discount if the payment will be made only a few days late.

After all, there is always more to learn. Such as, whether work cover policy covers the situation where an employee gets injured while working overseas for business trips or across the states. Therefore, we should always treat each case based on the state and refer to supporting documents without assumption.

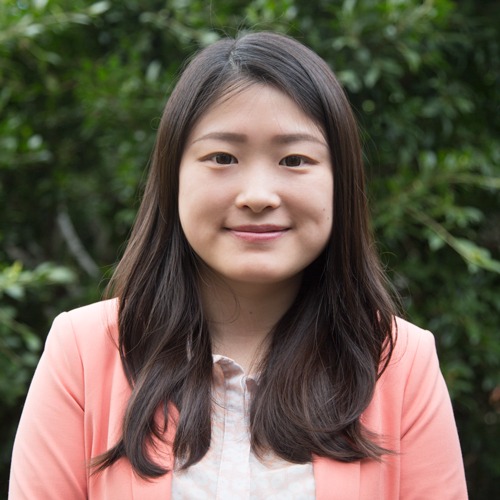

Navigating through the complexities of workers’ compensation insurance can be challenging, especially when dealing with the nuances of premiums, state variations, and legal requirements. But you don’t have to do it alone! Contact us to schedule a consultation, and let us show you how we can make a difference in your workers’ compensation management.

October 25, 2023

October 25, 2023