5 Pillars To Meaningful Intercultural Communication

There is an increasing focus in modern business on being global, diverse, and cosmopolitan. But why? Whilst you may think of these as little more than fun buzz words, understanding globality and diversity is crucial in today’s international environment – corporate or otherwise. Because this is the reality and future of the world… Read more »

Future-Proofing Employee-Employer Relationships

As we traverse the evolving landscape of employee-employer dynamics, it becomes evident that traditional paradigms are undergoing profound transformations. The contours of the modern workplace are shaped by nuanced expectations and interwoven complexities, demanding a human-centric approach to foster harmonious relationships and sustainable growth. In this article, we will delve into the various facets of… Read more »

8 Things You Should Know About Spain’s Business Culture

Embarking on a professional journey in Spain involves more than just mastering the language and loving the weather and the beautiful beaches; it requires a nuanced understanding of the country’s unique business culture and practices. Spain has become a hub for tech companies and young talent, but it is important to know how business is… Read more »

Unleashing the Power of Digital Change for Your Business

Digital transformation refers to the integration of digital technologies into various aspects of a business, resulting in fundamental changes to how the organisation operates, delivers value to customers, and engages with stakeholders. It involves leveraging digital tools, technologies, and data to enhance business processes, improve efficiency, and create new opportunities for growth and innovation. The… Read more »

Lunar New Year 2024: What to Expect This Chinese New Year

Sunday, 10th February 2024 marks the beginning of the new lunar year. This year will be the Year of the Dragon, the fifth of all zodiac animals. This period stands out for its rarity and significance, emphasising the pursuit of dreams, creativity, and the expansion of horizons. It invites a year of generosity, compassion, and… Read more »

7 Things to Consider When Relocating an Employee to France

France is not only the country of baguette, good cheese, and excellent wine. It is much more complex and offers its challenges when in day-to-day living. Below are some tips to ensure that your employees settle well when relocating to this country: Improve your employee experience. A change in professional life leading to a change… Read more »

Unlocking Success: The Power of Talent Mapping in Competitive Markets

In the dynamic landscape of today’s talent market, staying ahead requires strategic insights and a proactive approach. One invaluable tool that organisations are leveraging to gain a competitive edge is talent benchmarking or market mapping. What is Talent Mapping? Talent benchmarking involves a comprehensive analysis covering salary ranges, benefits, qualifications, experience, and job responsibilities of… Read more »

How to Leverage Your Employer Branding for Talent Acquisition

In today’s competitive job market, it’s not enough to simply offer a competitive salary and benefits package to attract top talent. Companies must also have a strong brand culture that resonates with potential employees. But what exactly is brand culture, and how can you leverage it for talent acquisition? In this article, we’ll explore the… Read more »

Keep up to Date with 2024 Public Holidays in Australia

In Australia, there are 8 national public holidays observed as part of the National Employment Standards (NES) that underpin employment throughout the country. In addition to these key dates, some states and territories also have additional regional public holidays or substitute public holidays. Substitute public holidays mean that if a public holiday falls on… Read more »

Polyglot Bronze Winner in the HRD’s Service Provider Awards for Recruitment Firms

Polyglot, your trusted boutique recruitment consultancy, is thrilled to share the exciting news of securing the bronze medal in the recruitment firms category at the esteemed Human Resources Director’s sixth annual Service Provider Awards. This prestigious accolade is not just a recognition of our commitment to excellence but a celebration of our shared success in… Read more »

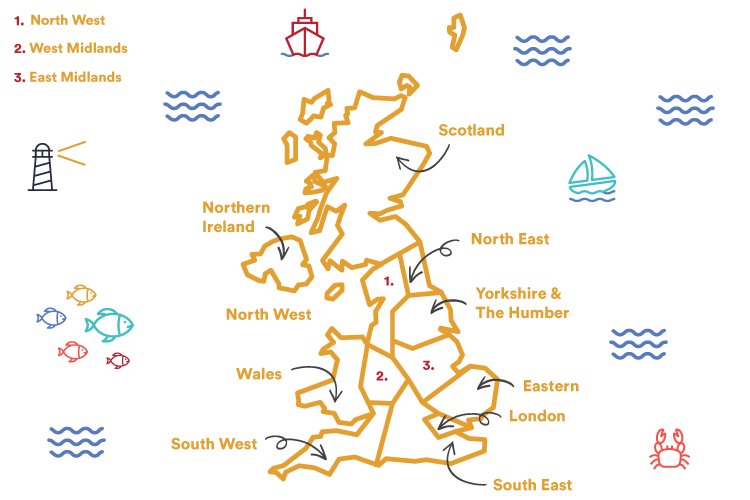

United Kingdom

The union of England,

Scotland, Wales, and

North Ireland

Interested in doing business in the UK?

Here’s what you need to know about the

business climate, laws and regulations,

culture, and customs in the United Kingdom.

Country Snapshot

Official Language

British English

Currency

British Pound Sterling (GBP)

Economy

5th in the world

World Zone

Europe

Capital

London

-

Key Facts & Figures

Location

Located off the north-western coast of mainland Europe, the United Kingdom includes the entire island of Great Britain, containing England, Wales and Scotland, as well as a northern portion of the island of Ireland.

The UK only has one land border with the Republic of Ireland and is otherwise surrounded by the North Sea, Irish Sea, English Channel and Atlantic Ocean. Although not necessarily among the largest countries in the world, it is among the largest islands, ranking 8th in the world.

Population

The UK’s population is approximately 67.2 million people as of 2020. Growth has slowed in past years, driven largely by migration to and from the UK, something that has remained constant since 2016. The structure of the population is shifting more towards people living longer and having fewer children, as well as an increase in cohabiting families across multiple generations.

The UK ranks as the 9th wealthiest nation in terms of median wealth per capita, at roughly $97,169 per adult. This wealth is increasingly present in the population aged in their 60s.

-

Economy

Although the British economy has faced some challenges since the 2016 Brexit referendum, it maintains a high position in international rankings, as the 5th largest economy in the world.

There is still some uncertainty as to how and when the UK will exit the European Union. This has caused a significant impact on business investment, with negative growth rates in 2019. This trend is expected to continue until all Brexit-related uncertainty is resolved. Consumer spending will continue to drive the economy, as it is predicted to maintain modest growth at 1.4% in 2019, 1.3% in 2020 and a 2.0% trend rate in the long-term.

Trade

The UK is dependent on imports for most of its metals, raw materials and food. This has encouraged the government to support free and unrestricted trade with its trading partners and memberships with international trade organisations. This, however, is set to change with the finalisation of a Brexit deal, in which the country will need to renegotiate many of its trade deals. The UK plans to take advantage of this opportunity to establish more favourable terms with its international partners.

Although the UK may experience a trade deficit, it has been able to offset the imbalance with foreign investments. The UK is the second-largest investment destination in the world.

Top Imports & Exports

Most of the UK’s largest trading partners are countries within the European Union. The United States and China are also significant partners, together forming nearly 15% of both the UK’s export and import values. The export value in 2017 was $395 billion, while imports came in at $617 billion. The UK is ranked as the 10th largest export economy in the world and the 11th most complex economy according to the Economic Complexity Index.

The country’s main imports and exports are largely the same, consisting of cars, packaged medication, crude petroleum, refined petroleum and gold. The UK does not have an abundance of natural resources, and instead trades in the sphere of manufactured products, importing the raw materials required for production.

Free Trade Agreements

Without any concrete decisions made towards Brexit, it is difficult to say exactly how the trade agreements between the UK and the European Union will unfold. For the moment, the UK has signed several trade agreements in preparation for when the country leaves the EU.

These agreements include the Andean countries, CARIFORUM trade bloc, Central America, the Eastern and Southern Africa trade bloc, the Southern Africa Customs Union and Mozambique trade bloc, as well as a few independent countries.

Additionally, the UK has signed mutual recognition agreements with Australia, New Zealand and the United States. These agreements state that the countries involved recognise each other’s conformity assessments in terms of performance standards.

One of their most recent agreements is The Australia-United Kingdom Free Trade Agreement signed 17 December 2021, this agreement will see an elimination of 99% of tariffs on exports between the two countries, as well as other benefits.

-

Legislation

Expanding to the UK? Here is a breakdown of the key things to keep in mind.

Company Setup

The UK presents numerous business opportunities for expanding multinational companies. Setting up a business in the UK can be done through various methods, such as setting up a standalone UK limited company, opening a Partnership company or Subsidiary, or registering a branch / UK establishment.

Employment

All employees in the UK have an employment contract with their employer. A contract is an agreement that sets out an employee’s employment conditions, salary, rights, responsibilities and duties. These are called the ‘terms’ of the contract. Other information regarding the probationary period, benefits and commissions are often included.

Employees and employers must stick to a contract until it ends (for example, by an employer or employee giving notice or an employee being dismissed) or until the terms are changed (usually by agreement between the employee and employer).

Employees have several rights including statutory sick, parental leave and redundancy pay. The typical working day hours are from 9 am to 5 pm.

Immigration

The Tier 2 (General) visa is the most commonly-used visa to employ skilled foreign workers from outside of the EU in the UK. This visa requires the applicant to be offered a recognised, skilled job in the UK by a licensed sponsor. Until the UK leaves the EU, it will continue to have access to its vast talent pool. These regulations will change once a decision about Brexit has been made.

Payroll

Payroll in the UK operates under a PAYE (Pay As You Earn) system that allows the HM Revenue and Customs (i.e. the national tax authority) to collect income tax and national insurance from employment. Your company’s payroll will need to take this into account when paying your employees. The rate of employer national insurance is 13.8% and is applied to all earnings over 702 pounds per month.

The payroll taxes paid by companies in the UK are equal to the total amount of PAYE, employer and employee national insurance and student loans.

Tax

In the UK, the financial year ends on 5th April, but your tax filing deadline could differ depending on your accounting period. The deadline is typically 9 months and 1 day after the end of your accounting period. The main thing to remember is that you need to pay your corporation tax prior to filing for a company tax return.

The UK also has a value-added tax (VAT) that is applied to the final consumption of goods and services. This tax applies to most business-related goods and services and is typically taxed at a rate of 20%. VAT returns must be submitted on a quarterly basis.