The new financial year has arrived, bringing significant changes to Australian taxation & payroll.

The first step in remaining compliant is understanding your business’ new payroll obligations. To help in this regard, we’ve examined the latest changes and summarised them for your convenience.

Fast-track your research with this guide to the 2022 / 2023 financial year.

Superannuation Employer Contribution Rate Increase

The Super Guarantee increases to 10.5% (from 10%) as of 1st of July 2022.

Removal of $450 minimum super guarantee threshold. Employees are now required to pay eligible employees superannuation regardless of how much the employee is paid.

Employees under the age of 18 years still need to satisfy the 30 hr per week rule.

This will have an impact on your Australian operations, from a budgetary perspective.

Concessional and Non- concessional caps will remain unchanged at $27,500 and $110,000 respectively.

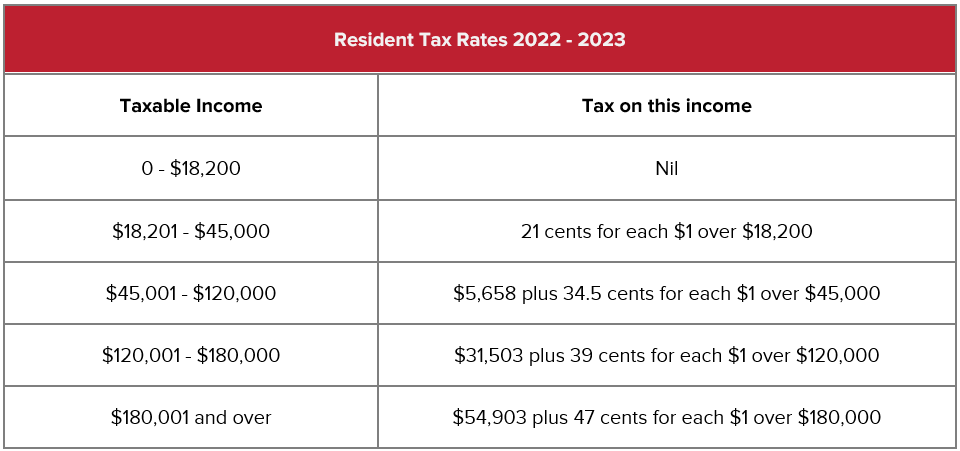

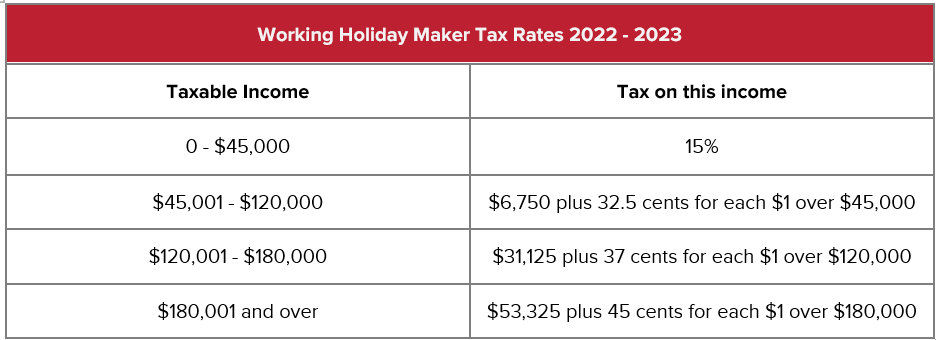

Individual Income Tax Rates

Individual income tax rates will remain unchanged for the 2022-23 year and are as follows:

The above rates do include the Medicare levy of 2% for tax residents.

Employers with Working Holiday Makers, will need to register the business with the ATO.

The STSL tax free threshold for 2022-23 is $48,359.48 based on tax-free threshold being claimed.

Further information can be found here.

Minimum Wages

The Fair Work Commission has announced an increase of 5.2% to the national minimum wage. The increase will apply from the first full pay period starting on or after the 1st of July 2022.

The national minimum wage will be $812.60 per week, or $21.38 per hour. The hourly rate has been calculated by dividing the weekly rate by 38, on the basis of the 38-hour week for a full-time employee.

The increase of minimum wages will also apply to most Modern Awards as of 01 July 2022 with the exception of the below:

01 October 2022 wage increase for aviation, Hospitality and Tourism Awards.

Refer to this link to check which award applies to your company to commence the new minimum wages.

High income Threshold and compensation Cap has increased to $162,000 from 01 July 2022. Employees who earn above this cap, will no longer be covered under the relevant award and unable to apply for unfair dismissal through the Fair work Commission.

Note that this may have an impact on your Australian operations, from a budgetary perspective.

Key Rates and Thresholds

Lump Sum D Threshold

The Lump Sum D threshold will increase to $11,591 + $5,797 for each completed year of service.

ETP thresholds

The ETP indexed cap is changed to $230,000 from 1st of July 2022.

The Whole of Income cap remains at $180,000 as this is a non-indexed figure.

Quarterly Maximum Employer Super Contribution Cap

Will increase to $6,323.10 per quarter from 1st of July 2022. (This represents an annual equivalent of $25,292.40)

Quarterly Maximum Employee Contribution Base

For the financial year 2022-23, the maximum quarterly employee contribution base is $60,220.

Overtime Meal Allowance

For the financial year 2022-2023, the reasonable amount for overtime meal allowance is $33.25.

Cents per km – car

For the financial year 2022 / 2023, when employees use their own car for business-related travel, they should receive 78 cents per kilometre allowance to help cover the costs.

Government Parental Leave Pay

Has increased to $812.45 per week ($162.49 per day before tax).

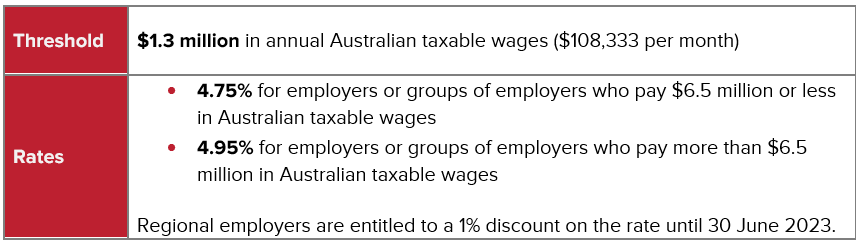

Payroll Tax Thresholds – FY 2022– 2023

New South Wales (NSW)

Payroll tax threshold is $1,200,000 a year. Tax rate increased to 5.45%.

Victoria (VIC)

The payroll tax threshold will remain $700,000.

There are no changes to the normal payroll tax rate, which will remain at 4.85%.

The regional employer rate will remain 1.2125%.

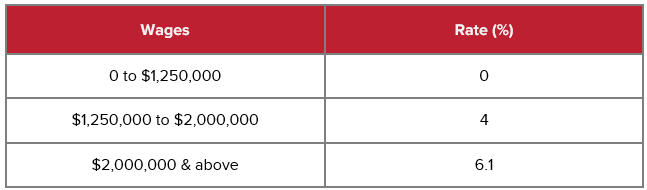

The mental health and well-being levy will be introduced from 1 January 2022. The mental health and well-being levy is a payroll tax surcharge on wages paid in Victoria by businesses with national payrolls over $10 million in a financial year. A rate of 0.5% will apply for businesses with national payrolls above $10 million. Businesses with national payrolls above $100 million will pay an additional 0.5%.

Queensland (QLD)

No change.

The Apprentice and Trainee payroll tax rebate has been extended for another 12 months until 30 June 2023. The scheme provides for a 50% rebate in relation to taxable wages paid to eligible apprentices and trainees, in addition to those wages already being exempt from payroll tax.

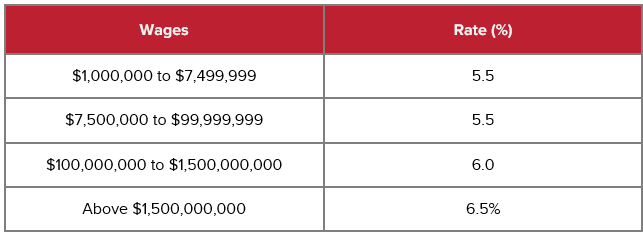

From January 2023, a mental health levy will be introduced. The levy of 0.25%, will apply to payroll tax liabilities of large employers, or groups of employers, with annual Australian taxable wages over $10 million. An additional levy of 0.7% will be applied to employers whose taxable wages over $100 million, providing a sustainable funding source for mental health services.

South Australia (SA)

No change.

The 2022-2023 SA Budget did not announce any new taxes, levies or duties, or any increases to existing taxes, levies or duties.

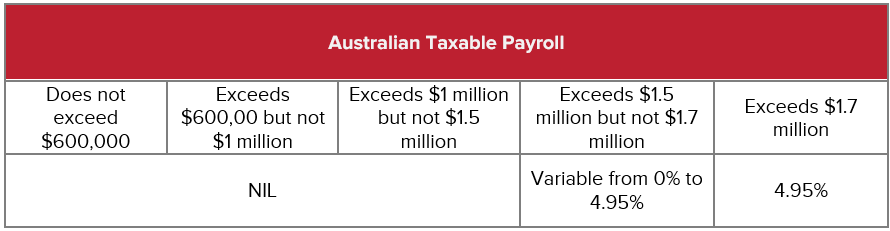

Western Australia (WA)

Tasmania (TAS)

Rates and thresholds for Tasmania will remain unchanged.

There are 2 payroll tax thresholds and rates for the 2022-23 financial year.

Australian Capital Territory (ACT)

Threshold $2,000,000. Rate 6.85% is unchanged

Northern Territory (NT)

Threshold $1,500,000. Rate 5.50% is unchanged

Long Service Leave Amendments

New South Wales (NSW)

Amendments to the Long Service Leave Act 1955 has been amended to allow for greater flexibility in how employers allow their employees to take their leave. These amendments are in response to COVID-19 and the impact it has on businesses and employees alike. Long Service Leave- Amendments

Changes include:

– The minimum periods in which leave can now be taken

– Accrual of leave during stand down periods

– Ability to postpone leave

– Taking of leave in advance of entitlement

Western Australia (WA)

Amendments to the Long Service Leave Act 1958 (LSL Act) has been amended with commencement date of 20 June 2022. Long Service Leave- Fact Sheet

Changes include:

– Entitlements applied to casual and seasonal workers

– Increased flexibility regarding how leave is taken

– Clarifying positions on continuous employment, cash out criteria and on what payment the leave is accrued.

– Record keeping requirements

Processing payroll is hardly an easy feat. Not only does it require a complex understanding of surrounding regulations, but also requires in-depth knowledge on how to apply it for your particular business.

Needing help with your payroll? Looking to assure compliance? Perhaps you need to outsource your payroll to a trusted partner. If still unsure of the benefits of outsourcing your payroll, check out our FAQs on why you should.

July 21, 2022

July 21, 2022